THE ANATOMY OF THE NEXT CRASH

Surprising though it might seem, barely two weeks have elapsed since those of us who anticipate GFC II – the sequel to the 2008 global financial crisis (GFC I) – were in a very, very small minority.

Consensus opinion, backed to the hilt by conventional economics, said that no such event was going to happen. Rather, we had entered the sunny uplands of “synchronised growth”, and debt had ceased to be anything much to worry about.

Of course, events, in Italy and elsewhere, haven’t yet proved us right, or the consensus wrong. We remain in a minority, though one that seems to be becoming larger. But events should embolden us, and on two fronts, not one.

First, recent developments strengthen the case for GFC II, not because of their seriousness alone, but because – as will be explained here – they conform to a logical pattern that points towards a coming crisis.

Second, we’re being reminded of quite how far conventional economics is out of touch with reality. This, of course, will be proved decisively if – or when – GFC II does happen.

This, when you consider its implications, is really quite remarkable. Government, business and finance all place heavy reliance on a school of thought which decrees that the workings of the economy are entirely financial – so, if events prove this approach to have been wrong, the ramifications will be enormous.

Those of us who understand that, far from being a matter of money, the economy is an energy system, have a lot of work in front of us.

This seems like a good point at which to publish the promised brief summary of why GFC II is likely.

ECoE starts to bite

Here is one big difference which makes the two contesting views of the economy incompatible. For anyone who believes in money-based interpretation, there are few (if any) logical barriers to perpetual growth in prosperity.

From an energy perspective, however, there is every reason to doubt the feasibility of indefinite expansion on a finite planet.

To be quite clear about this, what is contended here is not that we will “run out of” either petroleum or of energy more broadly. Rather, the argument is that we are running out of cheap energy.

“Cheap”, in this context, does not refer to sums of money invested in the supply of energy. Rather, it refers to the quantity of energy consumed whenever energy is accessed.

The definition used here is the energy cost of energy, or ECoE. Throughout much of our industrial history, the trend in ECoE has been downwards. This trend, beneficial for growing prosperity, was driven by geographical reach, economies of scale and technology.

In recent times, however, both reach and scale have plateaued, and technology has become a mitigator of ECoE increase rather than an accelerator of ECoE decrease. The driver now is depletion.

According to SEEDS, the global trend ECoE was 1.7% in 1980, and 2.6% in 1990. The difference between the two numbers was modest, and neither was a material (or, to most observers, even a noticeable) head-wind to growth.

Because the operative trend is exponential, however, ECoE was close to 4% by 2000, and had now become large enough to start driving a wedge between economic expectation and economic outcome.

The dynamic of sequential crises, part one – GFC I

By about 2000, then, underlying growth in prosperity was weakening, something not helped by the form of globalisation being promoted. Fading growth wasn’t something that conventional economics could explain, let alone accept.

What was apparent, however, was that the ability of Westerners to go on increasing their consumption was flagging, not least because of the outsourcing of skilled, well-paid jobs to the emerging market economies (EMs).

The solution to this seemed simple – give consumers easier and cheaper access to credit.

Two expedients combined to further this aim. The first was to drive down the real (ex-inflation) cost of borrowing. The second was to increase the availability of debt through “deregulation” of the financial sector. Both accorded with the prevailing ideology of laissez-faire economics, with its emphasis on diminishing the role (including the regulatory role) of the state.

Obviously enough, this strategy drove global debt upwards. Expressed in PPP dollars at constant 2017 values, world debt increased by 43%, from $121 trillion in 2000 to $174tn in 2007. Nobody in any position of influence seemed unduly concerned about this, because GDP had increased by a seemingly-impressive 53% over the same period.

Hardly anyone seemed to notice that each $1 of this growth had been accompanied by $2.08 of net new debt. Accordingly, the clear inference – that a big chunk of this “growth” was nothing more substantial than the simple spending of borrowed money – passed largely unnoticed.

The second, less obvious consequence of deregulation was the diffusion of risk, and the separation of risk from return. Various innovative practices enabled the creation of high-return, high-risk instruments which could be sliced in such a way that high risk was divested and high return retained. Surprisingly few observers noticed quite how dangerous this practice was likely to prove.

Risk-aversion revisited

The first – and, with hindsight, unmistakeable – portent of GFC I happened during the “credit crunch” of 2007. Banks, suddenly aware of elevated risk, couldn’t know which counterparties were safe, and which were not.

This was an instance of risk-aversion. What resulted was an interruption in the continuity of credit supply. This took down the small number of banks which had been reckless enough to finance their lending using short-term credit from wholesale markets. These aside, the system seemingly recovered from risk-aversion, though astute observers must by now have realised that the “credit crunch” might well be a precursor to something more systemic.

This 2007 chapter is highly relevant now, because we have entered a new phase of risk-aversion. Even before recent events in Italy, some of us had discerned the rise of risk-aversion, most obviously in the travails of a string of EM currencies. The probability is that this isn’t simply a function of a strengthening dollar, but reflects the withdrawal of capital from countries now seen as risky.

This time – and with a significance that will become obvious shortly – it is the creditworthiness of countries and their currencies which are being questioned, not just that of banks

This is why, here, we had started discussing GFC II, and commenting on its imminence, well before anything kicked off in the Euro Area (EA).

These events have not, then, changed our expectations. Rather, they have conformed to a pattern in which an outbreak of risk-aversion precedes a full-blown crisis.

The dynamic of sequential crises, part two – GFC II

So far, the dynamic of GFC II is conforming to the pattern of GFC I, with an episode of risk-aversion happening first. If the pattern continues, we will get through this chapter and breathe a collective sigh of relief – just in time for GFC II to catch us unawares.

This time, though, the fundamental dynamic is different, which means that the shape of GFC II will be different as well.

The explanation for this lies in how we responded to GFC I.

Put simply, during GFC I the authorities woke up to the obvious fact that the world had too much debt. Whenever debt becomes excessive – for a household, a business or a whole economy – the primary problem isn’t whether the debt can be repaid. At the macroeconomic level, at least, repayment can usually be deferred.

The big and immediate problem is servicing the debt – and this, by 2008, had become something that the world’s borrowers simply couldn’t afford to do. The logical solution seemed to be to slash interest rates.

This involved two processes, not one. The first, which was to take policy rates down to somewhere near zero, would never have been enough on its own. This was why massive QE programmes were launched, buying bond prices upwards in order to force yields sharply lower.

Defenders of QE argued that this didn’t amount to “printing” or otherwise creating new money, that it wasn’t monetisation of debt, and that it wouldn’t spark a sharp rise in inflation.

None of these assurances was, or is, cast-iron. QE isn’t the creation of money so long as it is reversed in good time. QE may not in principle be debt monetisation, but it certainly has become that in Japan, where QE money has been used by the BoJ to buy up nearly half of all JGBs in issue. It would be no huge surprise if the ECB, too, adopted monetisation as the least-bad way out of the looming debt crisis. And QE need not spark inflation, if by that term is meant rises in retail prices – but QE most assuredly has created huge inflation in the prices of assets.

A new adventurism

Be that as it may, what we have seen since GFC I has been “monetary adventurism”, which is distinct from the “credit adventurism” practised before 2008. The credit variety hasn’t gone away – indeed, it has worsened, with each dollar of “growth” since 2008 coming at a cost of $3.39 in new debt, compared with a ratio of 2.08:1 before GFC I – but monetary adventurism has leveraged its consequences.

The numbers are that, between 2008 and 2017, GDP increased by $28.8tn, but debt expanded by $98tn. Nor is this all. The destruction of returns on capital has created what the WEF has called “a global pension timebomb”, blowing a hole estimated by SEEDS at close to $100tn in worldwide pension provision adequacy. QE has poured something of the order of $28tn into the system. In the background, meanwhile, ECoE has continued to tighten its grip, rising from 5.3% in 2007 to 8.0% now.

To cut to the chase, most of the recorded “growth” in world GDP since 2008 has been cosmetic, amounting to nothing more substantial than the simple spending of borrowed money. As we have seen, this is corroborated by the concentration of “growth” towards the lower end of the value-added spectrum.

Bring the increase in ECoE into the equation as well and what we are looking at is a 10% ($7.6tn) increase in world prosperity trying to support a 54% ($98tn) expansion in total debt. Moreover, the 10% increase in aggregate prosperity has barely matched the rate of growth in population numbers. People have not been getting more prosperous, then, but they have been getting ever further into debt.

What on earth could go wrong with that?

Not like GFC I – the nature of GFC II risk

Thus far, with an episode of risk-aversion in the EM economies compounded by debt worries in Europe, events are following the pattern of GFC I.

But there are at least three reasons why we should not assume that GFC II will continue to look a lot like GFC I.

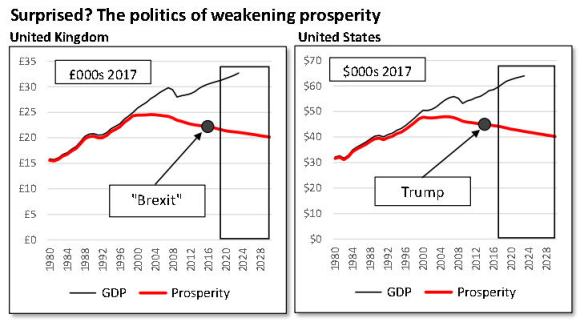

First, prosperity per person has been declining across almost all of the Western economies. The worst affected countries include France (a fall of 5.4% since 2007), Australia (-6.0%), the United States (-6.3%), Britain (-7.9%) and – of course – Italy, where prosperity has declined by 8.4%.

It is no coincidence at all that major political reverses for the establishment have happened in four of these five countries. Deterioration in prosperity seems certain to have informed the “Brexit” vote, the election of Mr Trump, the defeat of all established parties in the first round of presidential voting in France, and the triumph of Lega and M5S in Italy.

The relevance of this going forward, though, is something termed here “acquiescence risk”. This broadly means that populations undergoing hardship are likely to oppose any kind of rescue plan, especially if it is assumed by voters to involve rescues for an elite, and “austerity” for everyone else.

The second big difference between conditions now and those prevailing in 2008 is that recklessness has no longer been confined almost entirely to the developed economies of the West. This broader compass is hinted at by risk-aversion in the EMs. On the SEEDS risk matrix, China is now rated as riskier than any economy other than Ireland.

Third, and most important of all, a phase of “credit adventurism” which put banks at risk in 2008 has become a wave of “monetary adventurism” which puts fiat currencies themselves at risk.

What we should anticipate, then, is that GFC II will be truly global, not exempting EMs, and that, this time, currencies, and therefore national economies, will share a wave of risk previously (in 2008) borne largely by banks alone.

Precedent can help us anticipate why GFC II will happen – but will prove a poor guide to its shape and extent.

= = = = =

Since brevity was promised here, it is to be hoped that the foregoing provides a succinct summary of why GFC II is likely.

There seem certain to be plenty of opportunities for going into this in greater detail.

= = = = =

https://www.peakprosperity.com/video/236/playlist/153/chapter-17c-energy-and-economy

Chapter 17 from The Crash Course by Chris Martenson is an excellent summary of the Surplus Energy Problem There is an Excellent Video Presentation embedded in this Web Page.

This Paper has some good population doubling reasoning. It is firmly in the Misanthropic Camp and not my cup of tea ( comparing humans to Cancerous Growth) In its defence it is giving me some comedy gold for the Misanthropic Characters In My Nove.

Click to access doubling.pdf

Hi – a good clear video. I see (from YouTube) that it was published in 2008. A great pity that no one took any notice.

A year old but Chris explains the folly of all the Fed’s money printing exercise and how it benefited the few. It was a mouth water exercise in creating yet more greed.

Sorry here’s the link

Hi

I’d appreciate your evaluation of the recent action by HM Treasury as described in Richard Murphy’s Tax Research UK blog – see http://www.taxresearch.org.uk/Blog/2018/06/22/the-new-funding-structure-for-the-bank-of-england-suggests-that-the-treasury-thinks-the-proverbial-is-going-to-hit-the-fan/

As you may be aware our ramshackle Government continues to divert the populace from upcoming economic apocalypse by pressing ahead with secession from the EU by the end of this financial year. While the activity above could be construed as “blame shifting” by the Treasury onto the BoE in the event of almost-certain trade and economic Brexit damage to the UK, (one of the blog’s assertions), it is also possible the such damage could constitute the “tipping point” for the UK economy generally.

I’m assuming that bank account deposits of individuals are immune from “re-purposing” to contribute to offsetting any economic damage, as I assume this would require legislation to be enacted – can you confirm that this is the case in the UK?

TIA

Hi all I can say is that if labour get into power it’s certainly one of their plans to help pay off the National debt.

Old article (2013) but could be on some relevance.

https://www.telegraph.co.uk/finance/personalfinance/savings/9959615/Could-British-savers-face-a-Cyprus-style-raid.html

That would be the most incredibly stupid proposal!. The “National Debt” is savings accounts of bond/gilt holders held in BoE reserve accounts. They are there because the Lisbon Treaty mandates a sale of gilts to match the deficit. The money raised doesn’t have to be spent. It just has to balance the deficit account. The government’s spending is not affected.

Selling gilts is corporate welfare.

Hi this is from January this year

https://www.ft.com/content/fb397f44-e64b-11e7-97e2-916d4fbac0da

A totally clueless mob, and that includes the Press. Corbyn must be made to understand what being Monetary Sovereign actually means to a currency issuing government. It means their cheques don’t bounce. Whatever is the expense the government can meet it. The act of allotting money to pay for something the gov’t wants creates the money. So there is no debt hanging around for later payment. That is how the government feeds money into its economy.

Just don’t vote for Corbyn. To be honest whatever government is in power is going to have to cleanup a God awful financial mess.

I voted remain by the way because I was worried by the disruption if could cause in already dangerous times.

I did an experiment where I listed some of the negative things that might happen and posted them in the Daily mail pretending to be a leaver to see if it would sway their thinking. I got a ratio of 4 : 1 up to down votes telling me that ‘getting their country back’ was more important than anything else – including a damaged economy.

The article in the Mail was one about the Brexit protests in London yesterday.

‘Look here remoaners despite the fact it may cost the country some jobs – despite the fact there could be long delays at the docks – despite the fact it could cost families £1000 a year more due to the devaluation of the pound – despite the fact fruit could be left rotting in the fields – WE GOT OUR COUNTRY BACK.’

I think they feel that Brexit is going to be a panacea to all their problems no matter what.

Well, our “mob” here in Australia are equally clueless, so there is no remedy left except probably civil disobedience. The misunderstanding about how the currency works is just too ingrained that unless the politicians and their donors die off it won’t change before everything goes belly up. Labour UK and Labor Aus actually started the switch to neo liberalism alongside Mitterrand in France [and just about everywhere else], so they wear a lot of the responsibility for the mess today.

Max Planck who had trouble getting his quantum theory accepted, said progress happens one death at a time.

The future looks really bright too [not], Getting back on Tim’s track, I just saw this talk about our prospects from Richard Manning;

I had never heard of him, but he paints an all too realistic picture.

It’s a pretty grim video. I was shocked at the fact that originally it took only 1 calorie of energy to produce 1 calorie of food – now it takes 14 – obviously unsustainable.

Regarding the test post I put on the anti europe Daily mail – it shows that their readers do have sheep mentality. Now no one can be 100% sure of the full ramifications of the UK leaving the EU but my view has been that we don’t want to upset suppliers of goods and services who are on our doorstep. This is far more important than the ‘We got our country mentality’

By this I mean the transportation of goods in terms of energy costs from Europe is far lower than those from the US – China (when the going gets tough do you think that those two superpowers will care about the UK?)

Still amongst all the worry we might just crack Nuclear fusion……..

An interesting Video. Manning is certainly pretty certain of his own worldview and good luck to him.

Mannings own interpretation of his experiences, including Hunting, which are not dissimilar to my Own do not necessarily lead to a sort of romantic yearning for a Hunter-Gatherer existence.

The video is wide-ranging and a number of claims are made which are certainly highly debatable.

Chiefly the claim that Agriculture is by definition Unsustainable, Manning does contradict himself on this point several times, Contradiction is I think a good thing all outcomes are not inevitable from the same set of starting assumptions, Manning for me is very the United States oriented in his Biases it is of course pretty obvious that the US is taking far more than its fair share from the Planet, its own systems of Government and Cultural mores are mercifully not prevalent in the rest of the world.

How rigorously defendable Mannings position is remains to be seen. A monologue is not the best test of any hypothesis.

https://ourworldindata.org/fertilizer-and-pesticides

https://ourworldindata.org/energy-production-and-changing-energy-sources#transitioning-economies-and-declining-energy-intensity

Click to access c99045.pdf

These three links give some hard data on how much primary and secondary energy goes into Fertiliser and pesticide production, and also how they are actually declining both in terms of Energy consumption but also application.

This Film King corn explains much of what is wrong with the US model of Agriculture and Why.

Mannings addiction to the Superlative “Catastrophe” was for me a drawback in his central Thesis.

He also says that Erlich was not wrong the Outcome was actually wrong not the prediction.

All very well in Reality but does it work in Theory springs to mind.

Just my 5 cents worth, I will not be putting my head between my knees and kissing my backside goodbye on the strength of Mannings clearly sincere convictions though.

King Corn Link not working this one does I think.

The original King Corn film linked to a weird looking film – currently watching the second film with interest.

Good film. Of course as well as being extremely bad for you the weight gain by eating foods containing corn syrup means that more energy is needed to transport Americans around in cars and planes.

So they’re slowly poisoning themselves. I would like to see the percentage of healthcare costs in the US attributable to diabetes and the other effects of obesity.

But of course it’s not just the States – corn syrup is everywhere. I eat sugar reduced baked beans but I cannot avoid the stuff totally.

Donald and Others Interested

I have run across an original thinker in terms of chronic disease and degeneration:

Her thesis, in a nutshell, is that our gut microbes are screwed up as a result in inadequate vitamin D. The inadequate vitamin D is caused by the richer people in the world as well as those slaving away in factories and mines and big box stores, moving inside, rather than working outside, and watching screens for a living and for recreation. The screwed up microbes interfere with deep sleep, which is when we are supposed to do repairs. So our bodies accumulate more and more damage.

The solution is to take very large amounts of vitamin D along with a moderate dose of B vitamins which supply the raw materials needed for tissue repair.

I am pretty sure she would agree that there are lots of other second order problems, such as simply being sedentary. But unless we fix the gut, everything else is just a patch on a leaky bicycle tube.

Don Stewart

Interestly I was contacted to have a full health check last year. But due to budget cuts I was one of the lucky 800 (out of around 60,000) that got selected by the computer.

I was found to extremely deficient In vitamin D so had to go on a high dosage for a few months followed now by a lower dosage.

Of course many other could be affected which is why is must be a false economy not testing everyone. I’m sure the results would be shocking.

Mannings came across at times a grizzled survivor narrating life before and after an apocalypse.

I did like his video though –

MPs have just voted for a 3rd Heathrow airport. I’m not sure where all the energy is going to come from to power the extra flight.

Seems like a misguided expensive folly to me.

Thorcon .

http://euanmearns.com/thorcon-molten-salt-fission-power-plant/

Introduction

ThorCon is a molten salt fission reactor. Unlike all current operating reactors, the fuel is in liquid form. The molten salt can be circulated with a pump and passively drained in the event of an accident. The ThorCon reactor operates at garden hose pressures using normal pipe thicknesses and easily automated, ship-style steel plate construction methods.

Market Target

The first planned application of ThorCon reactors is to generate electric power in developing nations with fragile grids, so ThorCon is capable of demand discontinuities and black start without grid power. Capital cost and generated electricity costs are critical in these markets. ThorCon is cheaper than coal and deployable as rapidly. Indonesia completed a ThorCon pre-feasibility study in 2017.

Another very promising solution amongst many.

Certainly sounds impressive – I guess it’s got to fully prove itself before any adoption by major economies.

Hi Donald, yes proof of concept is important, if you watch the Debunk film I just posted some of the history of Nuclear Science and preference for Military Grade “By products” explains much better why the route Domestic Nuclear took back in the 50’s and into the 60’s.

An earlier question in this thread related to why certain technologies or social solutions are not pursued, is it because they are no good, not viable or perhaps that they take a dump on a dominant slice of the pie of special interests. We can all I am sure come up with possibilities in all of those catagories.

Just on Planned obsolescence the everlasting lightbulb documentary sort of sums up my own Cynical attitude to the objectives of “Democratic” Government.

https://en.wikipedia.org/wiki/Phoebus_cartel

at 26.32 mins comparison for corn ethonol 1.3 EROI thru to 2000 EROI on Thorium Molten Salt Reactor , not bad that.

So Thorium just shades it 🙂

Corn syrup seems to be the American way of ensuring people die early. It was never viable as a fuel unless the whole of mankind wants to go hungry.

Thorium debunked – I don’t know who is telling the truth.

No One can help you with that particular learning curve Donald.

HI this Guy seems pretty good

https://www.zmescience.com/ecology/what-is-molten-salt-reactor-424343/ it is the Molten Salt Breeder reactors which the Debunk film focuses on.

If you read the comments on the Thorcon link of the guest post http://euanmearns.com/thorcon-molten-salt-fission-power-plant/ you will see there is a discussion of fissile High-Level radioactive waste produced by the Uranium used in the fuel along with Thorium in the ThorCon process, https://en.wikipedia.org/wiki/Alvin_M._Weinberg actually bequeathed is a pure Thorium reactor which does not have the fissile by-products problem ( hence lack of Military Industrial Complex Support) and which operates at low pressures and relatively low temperatures which allow for safety features which are non mechanical and embedded in the process itself.

Fusion and Cold Fusion are different things. Whilst Plasma is very cool we do not actually need it right now , this is an excellent BBC documentary from a few years back.

Two hopes for the future of batteries / Capacitors –

https://about.bnef.com/blog/goodenough-making-progress-solid-state-batteries-qa/

They could help even out electrical supplies plus give EV’s a real future.

Despite our current situation there is hope on the horizon – Thorium reactors / Fusion reactors / new battery technology.

Very promising again. The UK recently allowed Hinkley point to go ahead which is due to start producing overpriced electricity sometime in the 2020’s. Many scientists were opposed to it – but out politicians wanted it (not the least so China wouldn’t be upset).

I just feel that all these new technologies are going to be 15 years too late.

Hi Donald, 15 years too late for what?

Catastrophists are forever moving out the dates of their dire predictions.

Personally, I do not think it is even a glass half full or glass half empty problem.

Natural Gas is quickly going to surpass Oil as the primary fuel source for an interregnum period, Coal stands by as a Fisrts reserve to Gas, Both of which will keep the lights on beyond 2050, when Oil is slated to have been used beyond economic (whatever that is, usefulness.

Meanwhile, in the youth team, we are bringing forward a promising crop of new players both in Attack ( generation ) and in Defence ( Storage) our Midfield strength in depth is also coming along very nicely with modern materials technology allowing for much more to be achieved with much less.

The most likely causes of the demise of our species is Nuclear Holocaust, this is by no means a certainty most of humanity does not believe it is possible to win a Nuclear War, MAD is still mad and most of the Human species is not Mad,

The other likely causes of our demises are Either Volcanic or Meteoric ( Asteroid ) collision events. There are plenty of sources of how likely and when these events are to occur, can we take precautionary measures against any of them, Maybe if we get lucky with the solutions we apply. I have been musing about how one might alleviate supervolcano activity? is it possible for instance to cause the magma pool to relieve horizontally rather than vertically avoiding at least the worse effects of a Volcanic winter? this could be a useful way of disposing of nuclear warheads? Shooting Eart impact Asteroids out of collision orbits could also be quite a good sport in the future.

Then there are the biological threats from pandemics, The Bird Flu, and Ebola Scares, even AIDS has been mooted as the coup de grace for our species at various points in the recent past.

Population levels slow down when infant mortality rates drop, and education levels increase with both an understanding of contraception and an incentive to use it naturally sees most people choosing to have smaller families, getting into the sociology and psychology of all of that is not necessary but google Hans Rosling and he has many lectures and ted talks on YouTube setting out the empirical evidence.

What the Human Family faces is not a production problem or even an Energy problem it is a distribution problem. The distribution mechanisms of Debt based financialised Capitalism do not operate efficiently under current potentials for production and distribution, There are many flavours of Capitalism, the less Greed Centred ones tend to do better based on the evidence available in Capitalisms brief history.

As a bit of light relief, this is a fun way of giving a hat tip to Bastiat’s petition of the Candlemakers.

The Four Horsemen of the Apocalypse have been with us since the first century AD, what are they and what do they signify?

https://en.wikipedia.org/wiki/Four_Horsemen_of_the_Apocalypse

As empire prosperity

“According to Edward Bishop Elliott’s interpretation, that the Four Horsemen represent a prophecy of the subsequent history of the Roman Empire, the white color of this horse signifies triumph, prosperity and health in the political Roman body. For the next 80 or 90 years succeeding the banishment of the apostle John to Patmos covering the successive reigns of the emperors Nerva, Trajan, Hadrian and the two Antonines (Antoninus Pius and Marcus Aurelius), a golden age of prosperity, union, civil liberty and good government unstained with civil blood unfolded. The agents of this prosperity personified by the rider of the white horse are these five emperors wearing crowns that reigned with absolute authority and power under the guidance of virtue and wisdom, the armies being restrained by their firm and gentle hands.[6]:129–131,134

This interpretation points out that the bow was preeminently a weapon of the inhabitants of the island of Crete and not of the Roman Empire in general. The Cretans were renowned for their archery skills. The significance of the rider of the white horse holding a bow indicates the place of origin of the line of emperors ruling during this time. This group of emperors can be classed together under one and the same head and family whose origins were from Crete.[6]:140,142–144

According to this interpretation, this period in Roman history, remarkable, both at its commencement and at its close, illustrated the glory of the empire where its limits were extended, though not without occasional wars, which were always uniformly triumphant and successful on the frontiers. The triumphs of the Emperor Trajan, a Roman Alexander, added to the empire Dacia, Armenia, Mesopotamia and other provinces during the course of the first 20 years of the period, which deepened the impression on the minds of the barbarians of the invincibility of the Roman Empire. Roman war progressed triumphantly into the invader’s own territory, and the Parthian war was successfully ended by the total overthrow of those people. Roman conquest is demonstrated even in the most mighty of these wars, the Marcomannic succession of victories under the second Antonine unleashed on the German barbarians, driven into their forests and reduced to Roman submission.[6]:131–133” From Wikipedia.

Looking back to Rome and to the previous Hegemonic Empires, and subsequent ones what can we learn regarding our present local difficulties.

Apparently, Gandhi said there is enough provided by nature in this world to satisfy all needs but there will never be enough to satisfy human greed.

The answer to that observation is surely to incentivise and reward moderation and cease celebrating and promoting Greed?

Ruskin Said this regarding Wealth.

“The whole question, therefore, respecting not only the

advantage, but even the quantity, of national wealth, resolves

itself finally into one of abstract justice. It is impossible to

conclude, of any given mass of acquired wealth, merely by the

fact of its existence, whether it signifies good or evil to the

nation in the midst of which it exists. Its real value depends on

the moral sign attached to it, just as sternly as that of a

mathematical quantity depends on the algebraical sign attached to

it. Any given accumulation of commercial wealth may be

indicative, on the one hand, of faithful industries, progressive

energies, and productive ingenuities: or, on the other, it may be

indicative of mortal luxury, merciless tyranny, ruinous chicane.

Some treasures are heavy with human tears, as an ill-stored

harvest with untimely rain; and some gold is brighter in sunshine

than it is in substance.” Ruskin, Unto this Last, Veins of wealth.

http://letthemconfectsweeterlies.blogspot.com/2011/05/ruskins-critique-of-classical-political.html

HI there – I put 15 years because there is a long lead to to get new reactors built and working.

I’m am still optimistic about the future be we cannot hide the fact that oil will get more and more expensive to extract and that the debt bubble that’s been hiding a lot of the real costs (and creating artificial growth) may go pop.

However I think we’ll muddle through. What people in my country are currently worrying about is the shortage of C02 which is needed to put the fizz into drinks.

Ridiculously they are starting to ration larger instead of teeth rotting – obesity creating soft drinks. So if there is a financial crisis we won’t even be able to drink our sorrows away.

There’s a huge irony here, isn’t there? Bubbles wherever else you look – property, stock prices and debt – but no bubbles in drinks!

And man made deserts where we need natural forests:

Ironically, or predictably, depending on just how cynical you are, my son tells me that the medical profession, after having done so much damage, is now concerned about the proliferation of lactation coaches, and has pushed thru some regulatory constraints in his state.

Anyway, baby poop may be the next export for poor countries, to be administered to the infants of the rich as a fecal transplant??? Wonder if Trump will put a tariff on it? Build a wall against it???

Don Stewart

Yes Tim very ironical. There do seem to be some decent energy solutions being developed but it’s a race against time.

I personal like the machine in Switzerland which extracts CO2 from the air and can convert it into pur CO2 which can then be used for growing greenhouse crops amongst other things.

Perhaps they can help with our fizzy drinks crisis.

https://www.bbc.co.uk/news/science-environment-41816332

It is Ironic Tim, Hilariously so. The Bubbles are CO2 and we have a famine of CO2 amongst plenty, In fact we are told far too much of the man-made stuff.

email to a friend just the other day.

https://www.bbc.com/news/business-44600298 This is kind of funny? what are these people doing putting pollutants into stuff? How many people do you think might make a connection between CO2 as Villain and CO2 as Vital resource?

CO2 CO2 everywhere – but not a drop for drink.